Give your patients the best care 👩⚕️

Give your patients the best care 👩⚕️

Give your patients the best care 👩⚕️

Get pre-approved treatments and direct payments

Get pre-approved treatments and direct payments

Get pre-approved treatments and direct payments

4.9

5.0*

Vet signup

Get in touch with Fetch to setup direct claims and payments

4.9

5.0*

How it works

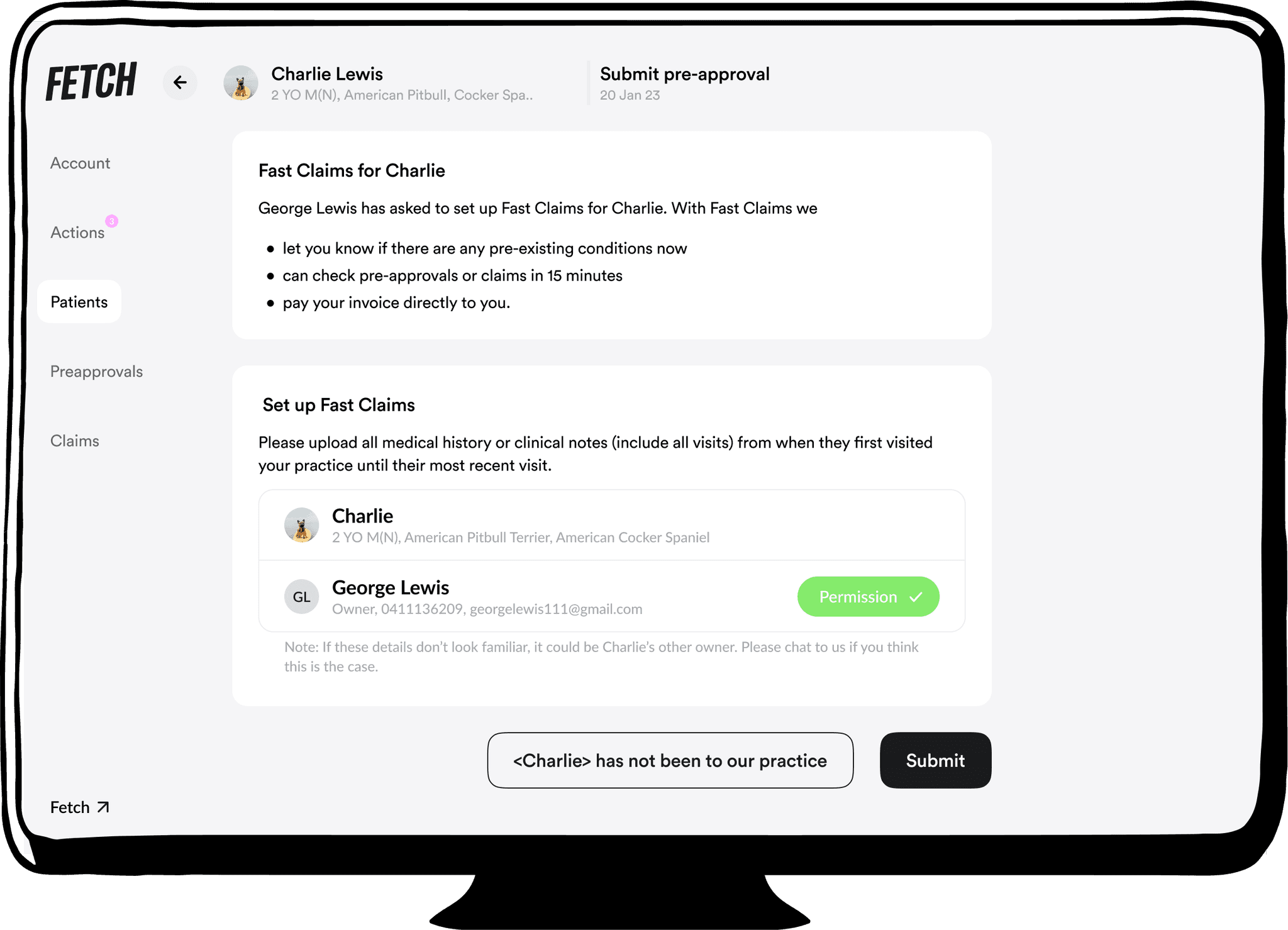

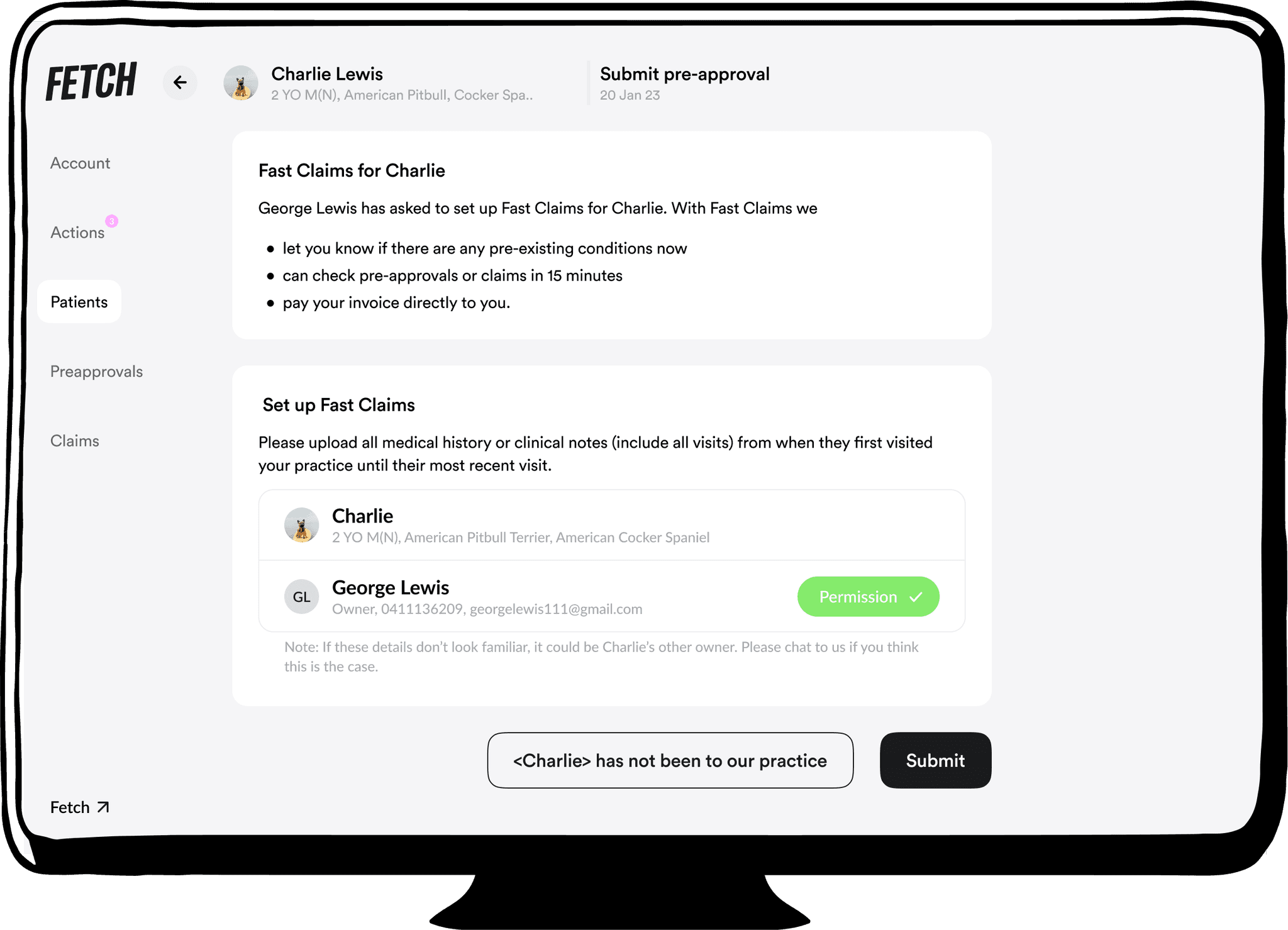

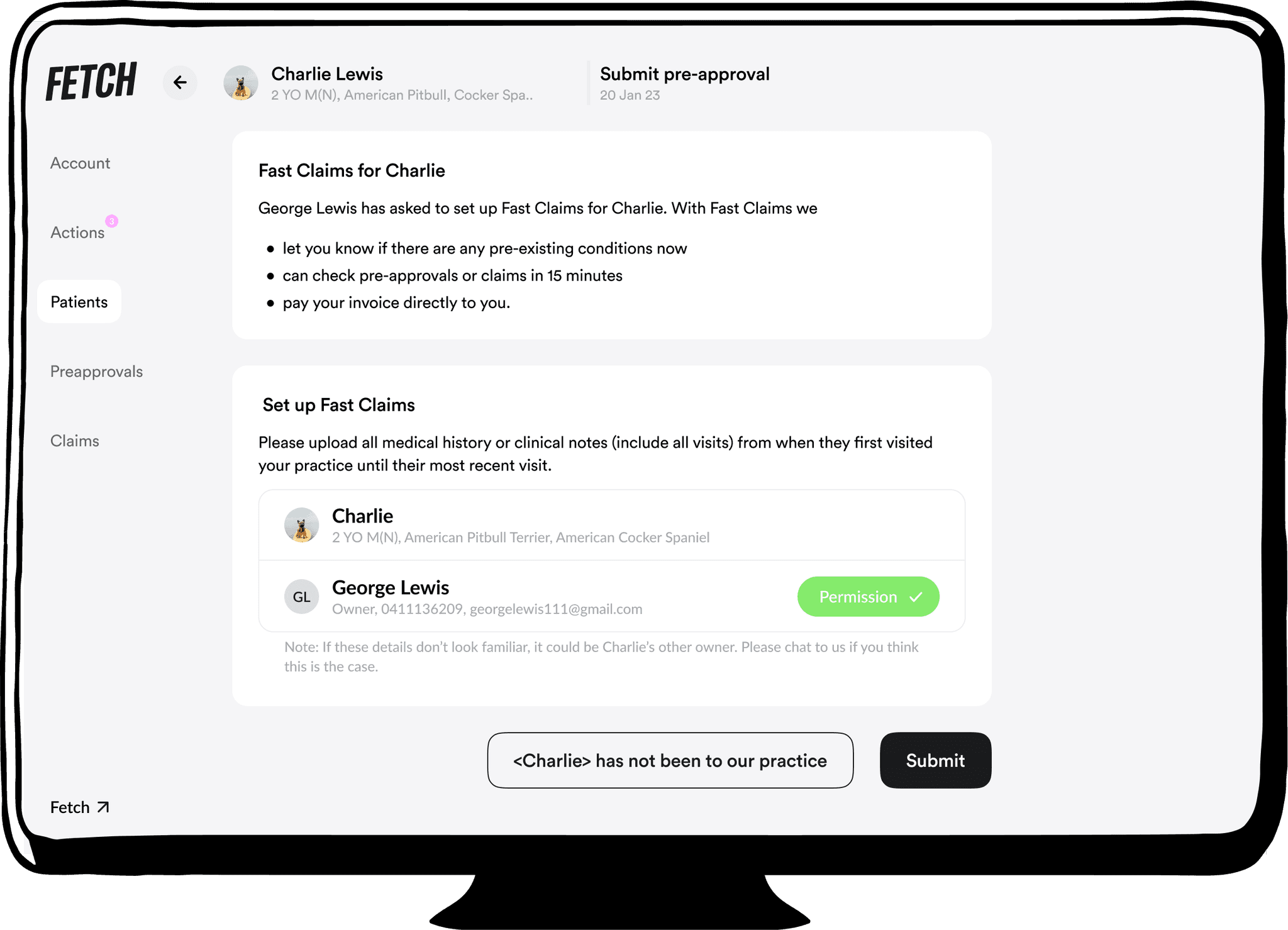

Upload pre-approvals or claims in a few clicks

Either through the Fetch vet portal, or where available directly through your PMS

Fetch checks your client's cover in 15 mins

Available after you & your client have set up Fast Claims and 9-5pm Weekdays, 9-3pm Sat, 9-1pm Sun AET

Your client pays their contribution in-app

Including their excess or remaining cover%, and any items not covered

Fetch pays you the full amount

Cover we think your clients will ❤️

Cover we think

you'll ❤️

Cruciate Ligament

$2,600

No Sub Limit

Hip Joint Surgery

$1,200

No Sub Limit

Skin Conditions

$500

No Sub Limit

Vet Consultations

$300

No Sub Limit

Cruciate Ligament

$2,600

No Sub Limit

Hip Joint Surgery

$1,200

No Sub Limit

Skin Conditions

$500

No Sub Limit

Vet Consultations

$300

No Sub Limit

$30k cover every year

$30k cover every year

$30k cover every year

Customers can cover up to 100% or get a $0 excess, with no inner vet sub-limits

Customers can cover up to 100% or get a $0 excess, with no inner vet sub-limits

Customers can cover up to 100% or get a $0 excess, with no inner vet sub-limits

All conditions covered

All conditions covered

All conditions covered

Fetch covers all conditions including hereditary ones, for all breeds - where the condition isn't pre-existing.

Fetch covers all conditions including hereditary ones, for all breeds - where the condition isn't pre-existing.

Hip Dysplasia

Cancer

IVDD

BOAS

Diabetes

Cruciates

🎓

Behaviour

🥣

Food

🦵

Physio

🦷

Dental

🛌

Board

🔎

Lost pets

Extras included

Extras included

Extras included

From health scares, to tooth troubles, or mental muddles - Fetch includes cover others don't.

From health scares, to tooth troubles, or mental muddles - Fetch includes cover others don't.

From health scares, to tooth troubles, or mental muddles - Fetch includes cover others don't.

"Really pleased with Fetch. Better value cover, and you can actually understand it."

Mini & Naomi

"I honestly haven't come across anyone with such comprehensive cover"

James & Kevin

"I was looking on all the major comparison sites Fetch stood out big time"

Chonk & Callum

Helpful info for Vets

Who's Fetch?

Who's Fetch pet insurance?

Hey 👋 we’re Fetch, a team of vets, techies, and insurance pros building amazing insurance 💚 and a go-to pet health app 📲. With experience caring for 1,000,000+ pets, all our team have backgrounds in pet health as vets or vet nurses, or with leading insurers around the world. We launched in 2023 and have already become the highest-rated pet insurance on ProductReview with a 4.9 ⭐️ rating.

We’ve created a super simple, easy-to-understand PDS with great cover. We can pay you directly so your client isn’t out of pocket. We have a vet portal where you to easily upload claims and histories. We’re now rolling out integrations with vet PMS systems. Want to get involved? Let us know at support@fetchpet.com.au.

We’re backed by a strong team of Aussie and international investors, including Airtree, vets, insurance CEOs, pet retailers, brand and marketing experts, start-up founders, and tech leaders. We have our own Australian Financial Services License (540762), and we’re underwritten by Pacific International Insurance (ABN 83 169 311 193).

Who's Fetch pet insurance?

Hey 👋 we’re Fetch, a team of vets, techies, and insurance pros building amazing insurance 💚 and a go-to pet health app 📲. With experience caring for 1,000,000+ pets, all our team have backgrounds in pet health as vets or vet nurses, or with leading insurers around the world. We launched in 2023 and have already become the highest-rated pet insurance on ProductReview with a 4.9 ⭐️ rating.

We’ve created a super simple, easy-to-understand PDS with great cover. We can pay you directly so your client isn’t out of pocket. We have a vet portal where you to easily upload claims and histories. We’re now rolling out integrations with vet PMS systems. Want to get involved? Let us know at support@fetchpet.com.au.

We’re backed by a strong team of Aussie and international investors, including Airtree, vets, insurance CEOs, pet retailers, brand and marketing experts, start-up founders, and tech leaders. We have our own Australian Financial Services License (540762), and we’re underwritten by Pacific International Insurance (ABN 83 169 311 193).

Who's Fetch pet insurance?

Hey 👋 we’re Fetch, a team of vets, techies, and insurance pros building amazing insurance 💚 and a go-to pet health app 📲. With experience caring for 1,000,000+ pets, all our team have backgrounds in pet health as vets or vet nurses, or with leading insurers around the world. We launched in 2023 and have already become the highest-rated pet insurance on ProductReview with a 4.9 ⭐️ rating.

We’ve created a super simple, easy-to-understand PDS with great cover. We can pay you directly so your client isn’t out of pocket. We have a vet portal where you to easily upload claims and histories. We’re now rolling out integrations with vet PMS systems. Want to get involved? Let us know at support@fetchpet.com.au.

We’re backed by a strong team of Aussie and international investors, including Airtree, vets, insurance CEOs, pet retailers, brand and marketing experts, start-up founders, and tech leaders. We have our own Australian Financial Services License (540762), and we’re underwritten by Pacific International Insurance (ABN 83 169 311 193).

Who is the insurer?

We look after you and your pet under our Australian Financial Services Licence (AFSL). This means Fetch takes care of everything from building the product, paying claims, to chatting to you about all things pets! The insurance is issued and underwritten by an APRA licensed underwriter called Pacific International Insurance, who have around 20 years insurance experience in Australia.

Who is the insurer?

We look after you and your pet under our Australian Financial Services Licence (AFSL). This means Fetch takes care of everything from building the product, paying claims, to chatting to you about all things pets! The insurance is issued and underwritten by an APRA licensed underwriter called Pacific International Insurance, who have around 20 years insurance experience in Australia.

Who is the insurer?

We look after you and your pet under our Australian Financial Services Licence (AFSL). This means Fetch takes care of everything from building the product, paying claims, to chatting to you about all things pets! The insurance is issued and underwritten by an APRA licensed underwriter called Pacific International Insurance, who have around 20 years insurance experience in Australia.

How does Fetch make money?

To look after you and your pet, we keep a flat percentage of every plan sold. Our percentage stays the same whether you make a claim or not. We operate under our Australian Financial Services Licence (AFSL), the insurance is underwritten by an APRA licensed underwriter called Pacific International, who have around 20 years insurance experience in Australia.

How does Fetch make money?

To look after you and your pet, we keep a flat percentage of every plan sold. Our percentage stays the same whether you make a claim or not. We operate under our Australian Financial Services Licence (AFSL), the insurance is underwritten by an APRA licensed underwriter called Pacific International, who have around 20 years insurance experience in Australia.

How does Fetch make money?

To look after you and your pet, we keep a flat percentage of every plan sold. Our percentage stays the same whether you make a claim or not. We operate under our Australian Financial Services Licence (AFSL), the insurance is underwritten by an APRA licensed underwriter called Pacific International, who have around 20 years insurance experience in Australia.

How does insurance work?

Does Fetch cover routine care or vaccinations?

We cover vet consults as part of diagnosis and treatment for covered condition. But, we don’t cover routine care like vaccinations, preventatives, or general check ups. You can read more here

Does Fetch cover routine care or vaccinations?

We cover vet consults as part of diagnosis and treatment for covered condition. But, we don’t cover routine care like vaccinations, preventatives, or general check ups. You can read more here

Does Fetch cover routine care or vaccinations?

We cover vet consults as part of diagnosis and treatment for covered condition. But, we don’t cover routine care like vaccinations, preventatives, or general check ups. You can read more here

How do pet insurance excesses and contributions work?

When your client makes a claim, they’ll need to pay an amount towards the claim, known as their contribution. This includes the excess, the remaining cover percentage, and any items that their pet’s plan doesn’t cover.

Excess: This is the fixed amount your client pays as part of their contribution towards a claim. They only pay it once per condition. For example, a cruciate rupture with subsequent arthritis in the knee would be one condition with one excess.

Cover Percentage: This is the amount Fetch covers after the excess is applied. For instance, if the claim is $1,000 with a $100 excess and 90% cover, your client pays $190 ($100 excess + 10% of $900), and Fetch covers $810.

How it works: If you allow direct payments, and during opening hours, Fetch can pay the invoice directly to you after your client has paid their contribution in-app. This includes the excess, cover percentage, non-covered items, and any amounts over their limit. If your client has already paid you, Fetch will reimburse them. 💵

For more details and examples, check our PDS.

How do pet insurance excesses and contributions work?

When your client makes a claim, they’ll need to pay an amount towards the claim, known as their contribution. This includes the excess, the remaining cover percentage, and any items that their pet’s plan doesn’t cover.

Excess: This is the fixed amount your client pays as part of their contribution towards a claim. They only pay it once per condition. For example, a cruciate rupture with subsequent arthritis in the knee would be one condition with one excess.

Cover Percentage: This is the amount Fetch covers after the excess is applied. For instance, if the claim is $1,000 with a $100 excess and 90% cover, your client pays $190 ($100 excess + 10% of $900), and Fetch covers $810.

How it works: If you allow direct payments, and during opening hours, Fetch can pay the invoice directly to you after your client has paid their contribution in-app. This includes the excess, cover percentage, non-covered items, and any amounts over their limit. If your client has already paid you, Fetch will reimburse them. 💵

For more details and examples, check our PDS.

How do pet insurance excesses and contributions work?

When your client makes a claim, they’ll need to pay an amount towards the claim, known as their contribution. This includes the excess, the remaining cover percentage, and any items that their pet’s plan doesn’t cover.

Excess: This is the fixed amount your client pays as part of their contribution towards a claim. They only pay it once per condition. For example, a cruciate rupture with subsequent arthritis in the knee would be one condition with one excess.

Cover Percentage: This is the amount Fetch covers after the excess is applied. For instance, if the claim is $1,000 with a $100 excess and 90% cover, your client pays $190 ($100 excess + 10% of $900), and Fetch covers $810.

How it works: If you allow direct payments, and during opening hours, Fetch can pay the invoice directly to you after your client has paid their contribution in-app. This includes the excess, cover percentage, non-covered items, and any amounts over their limit. If your client has already paid you, Fetch will reimburse them. 💵

For more details and examples, check our PDS.

Does pet insurance cover pre-existing conditions?

Unfortunately, we can’t cover pre-existing conditions 🙁. These could be any injury, illness, behavioural problem, or other issue that started before your client's pet's cover is active (including in any waiting periods ⏱️). This also includes any signs or symptoms your client noticed, even if the condition hasn’t yet been seen or diagnosed by a vet.

Pre-existing conditions could include hereditary or congenital conditions, as well as bilateral conditions or linked conditions which are related to other conditions, for example, arthritis following joint damage.

Why doesn’t Fetch cover pre-existing conditions?

Like most pet insurers, we can’t cover pre-existing conditions because our cover and pricing are set at a rate that assumes your client's pet has the usual chance of having any issues for their breed, not if they already have them. However, we’d like to be able to design a product that could cover pre-existing conditions in the future.

When will my client find out about their pet’s pre-existing conditions?

The great thing about Fetch, is our Fast Claims ⚡️ process, where we check for any pre-existing conditions so you and your client know this upfront, rather than at claim time. Once Fast Claims have been set up and if we’ve also got your payment details, we can check your claims quickly and pay the entire invoice directly to you the vet. Your client only have to pay us their excess and contribution (including any excluded items).

Where can I see my client's pet’s pre-existing conditions?

Your client will be able to see these and any linked conditions in the plan section of their app.

How does Fetch determine pre-existing conditions?

We base this primarily on your vet notes and we look at pre-existing conditions on a true ‘cause and effect’ basis, rather than just excluding things because they are the same sign or symptom, or happened a few times.

What are some examples of pre-existing conditions for pets?

Seasonal allergies 🤧: If a pet requires treatment every spring for a seasonal skin condition, it is considered pre-existing.

Cushing's disease: Once diagnosed, the condition becomes ongoing and is likely to require lifelong treatment.

Limping following a jump from a car: if the limping is found to be due to a ruptured cruciate which happened when your pet jumped from the car, the ruptured cruciate and any other related issues like arthritis in the joint would be pre-existing. If it was a one off sprain which healed, it wouldn’t be pre-existing.

Behavioural issues: Unfortunately any previous behavioural issues, even if temporary, mean we can’t provide behavioural cover. See more here.

Dental disease: If you have noted dental disease, we won’t be able to offer dental cover. Dental cover doesn’t impact other issues in the mouth (like tumours, or fractures) as long as they are unrelated to dental disease or pre-existing dental problems, see more here.

Elbow Arthritis: Even if diagnosed at an early stage when no treatment is required, the presence of arthritis in a particular location will progress so the condition is pre-existing.

Hip dysplasia: Diagnosed before taking out a plan or during waiting periods, it won't be covered, including related conditions like arthritis in the hips.

What are some conditions that aren't considered pre-existing?

Vomiting from eating something on a walk: If your client's pet ate something on a walk and became sick before their plan started, it’s not considered pre-existing if it happens again after the plan starts.

Diarrhoea from overeating: As long as it didn’t lead to permanent damage, it’s not considered pre-existing.

If there’s anything else you’d like to know, or if we can be clearer on anything, please let us know!

Does pet insurance cover pre-existing conditions?

Unfortunately, we can’t cover pre-existing conditions 🙁. These could be any injury, illness, behavioural problem, or other issue that started before your client's pet's cover is active (including in any waiting periods ⏱️). This also includes any signs or symptoms your client noticed, even if the condition hasn’t yet been seen or diagnosed by a vet.

Pre-existing conditions could include hereditary or congenital conditions, as well as bilateral conditions or linked conditions which are related to other conditions, for example, arthritis following joint damage.

Why doesn’t Fetch cover pre-existing conditions?

Like most pet insurers, we can’t cover pre-existing conditions because our cover and pricing are set at a rate that assumes your client's pet has the usual chance of having any issues for their breed, not if they already have them. However, we’d like to be able to design a product that could cover pre-existing conditions in the future.

When will my client find out about their pet’s pre-existing conditions?

The great thing about Fetch, is our Fast Claims ⚡️ process, where we check for any pre-existing conditions so you and your client know this upfront, rather than at claim time. Once Fast Claims have been set up and if we’ve also got your payment details, we can check your claims quickly and pay the entire invoice directly to you the vet. Your client only have to pay us their excess and contribution (including any excluded items).

Where can I see my client's pet’s pre-existing conditions?

Your client will be able to see these and any linked conditions in the plan section of their app.

How does Fetch determine pre-existing conditions?

We base this primarily on your vet notes and we look at pre-existing conditions on a true ‘cause and effect’ basis, rather than just excluding things because they are the same sign or symptom, or happened a few times.

What are some examples of pre-existing conditions for pets?

Seasonal allergies 🤧: If a pet requires treatment every spring for a seasonal skin condition, it is considered pre-existing.

Cushing's disease: Once diagnosed, the condition becomes ongoing and is likely to require lifelong treatment.

Limping following a jump from a car: if the limping is found to be due to a ruptured cruciate which happened when your pet jumped from the car, the ruptured cruciate and any other related issues like arthritis in the joint would be pre-existing. If it was a one off sprain which healed, it wouldn’t be pre-existing.

Behavioural issues: Unfortunately any previous behavioural issues, even if temporary, mean we can’t provide behavioural cover. See more here.

Dental disease: If you have noted dental disease, we won’t be able to offer dental cover. Dental cover doesn’t impact other issues in the mouth (like tumours, or fractures) as long as they are unrelated to dental disease or pre-existing dental problems, see more here.

Elbow Arthritis: Even if diagnosed at an early stage when no treatment is required, the presence of arthritis in a particular location will progress so the condition is pre-existing.

Hip dysplasia: Diagnosed before taking out a plan or during waiting periods, it won't be covered, including related conditions like arthritis in the hips.

What are some conditions that aren't considered pre-existing?

Vomiting from eating something on a walk: If your client's pet ate something on a walk and became sick before their plan started, it’s not considered pre-existing if it happens again after the plan starts.

Diarrhoea from overeating: As long as it didn’t lead to permanent damage, it’s not considered pre-existing.

If there’s anything else you’d like to know, or if we can be clearer on anything, please let us know!

Does pet insurance cover pre-existing conditions?

Unfortunately, we can’t cover pre-existing conditions 🙁. These could be any injury, illness, behavioural problem, or other issue that started before your client's pet's cover is active (including in any waiting periods ⏱️). This also includes any signs or symptoms your client noticed, even if the condition hasn’t yet been seen or diagnosed by a vet.

Pre-existing conditions could include hereditary or congenital conditions, as well as bilateral conditions or linked conditions which are related to other conditions, for example, arthritis following joint damage.

Why doesn’t Fetch cover pre-existing conditions?

Like most pet insurers, we can’t cover pre-existing conditions because our cover and pricing are set at a rate that assumes your client's pet has the usual chance of having any issues for their breed, not if they already have them. However, we’d like to be able to design a product that could cover pre-existing conditions in the future.

When will my client find out about their pet’s pre-existing conditions?

The great thing about Fetch, is our Fast Claims ⚡️ process, where we check for any pre-existing conditions so you and your client know this upfront, rather than at claim time. Once Fast Claims have been set up and if we’ve also got your payment details, we can check your claims quickly and pay the entire invoice directly to you the vet. Your client only have to pay us their excess and contribution (including any excluded items).

Where can I see my client's pet’s pre-existing conditions?

Your client will be able to see these and any linked conditions in the plan section of their app.

How does Fetch determine pre-existing conditions?

We base this primarily on your vet notes and we look at pre-existing conditions on a true ‘cause and effect’ basis, rather than just excluding things because they are the same sign or symptom, or happened a few times.

What are some examples of pre-existing conditions for pets?

Seasonal allergies 🤧: If a pet requires treatment every spring for a seasonal skin condition, it is considered pre-existing.

Cushing's disease: Once diagnosed, the condition becomes ongoing and is likely to require lifelong treatment.

Limping following a jump from a car: if the limping is found to be due to a ruptured cruciate which happened when your pet jumped from the car, the ruptured cruciate and any other related issues like arthritis in the joint would be pre-existing. If it was a one off sprain which healed, it wouldn’t be pre-existing.

Behavioural issues: Unfortunately any previous behavioural issues, even if temporary, mean we can’t provide behavioural cover. See more here.

Dental disease: If you have noted dental disease, we won’t be able to offer dental cover. Dental cover doesn’t impact other issues in the mouth (like tumours, or fractures) as long as they are unrelated to dental disease or pre-existing dental problems, see more here.

Elbow Arthritis: Even if diagnosed at an early stage when no treatment is required, the presence of arthritis in a particular location will progress so the condition is pre-existing.

Hip dysplasia: Diagnosed before taking out a plan or during waiting periods, it won't be covered, including related conditions like arthritis in the hips.

What are some conditions that aren't considered pre-existing?

Vomiting from eating something on a walk: If your client's pet ate something on a walk and became sick before their plan started, it’s not considered pre-existing if it happens again after the plan starts.

Diarrhoea from overeating: As long as it didn’t lead to permanent damage, it’s not considered pre-existing.

If there’s anything else you’d like to know, or if we can be clearer on anything, please let us know!

How do pet insurance waiting periods work?

A waiting period ⏱️ is the period of time your clients will need to wait for their coverage to begin after their pet's plan starts.

Fetch Pet insurance waiting periods

At Fetch, we have specific waiting periods for different types of cover:

Injuries (e.g., a broken leg from a fall or a cut paw): 48 hours

Illnesses (e.g., a tumor or kidney disease): 30 days

Specific Conditions (Cruciate Ligaments, Patellar Luxation, Hip Dysplasia, Elbow Dysplasia, BOAS, Cherry Eye): 90 days

Skip waiting periods with Fetch ⏭️

Fetch allows your clients to skip the waiting periods through a simple in-app process. 📲 After signing up, they need to follow the instructions to show their pet looking healthy. If everything checks out, Fetch can skip the waiting periods for their pet. ✅ This review is usually completed within 1 working day.

In the cover section of the app, clients can see the countdown of waiting periods and when they’re skipped.

Fast Claims and pre-existing condition checks 👩⚕️

Waiting periods are separate from checks for pre-existing conditions. These conditions might still be excluded as a pet could appear healthy but have underlying or ongoing issues.

Fetch offers an upfront check for pre-existing conditions. After signing up, clients need to provide their vet's details in the app. Fetch will contact the vet for the pet's records and inform the clients of any pre-existing conditions that aren’t covered. This process usually takes a few weeks.

How do pet insurance waiting periods work?

A waiting period ⏱️ is the period of time your clients will need to wait for their coverage to begin after their pet's plan starts.

Fetch Pet insurance waiting periods

At Fetch, we have specific waiting periods for different types of cover:

Injuries (e.g., a broken leg from a fall or a cut paw): 48 hours

Illnesses (e.g., a tumor or kidney disease): 30 days

Specific Conditions (Cruciate Ligaments, Patellar Luxation, Hip Dysplasia, Elbow Dysplasia, BOAS, Cherry Eye): 90 days

Skip waiting periods with Fetch ⏭️

Fetch allows your clients to skip the waiting periods through a simple in-app process. 📲 After signing up, they need to follow the instructions to show their pet looking healthy. If everything checks out, Fetch can skip the waiting periods for their pet. ✅ This review is usually completed within 1 working day.

In the cover section of the app, clients can see the countdown of waiting periods and when they’re skipped.

Fast Claims and pre-existing condition checks 👩⚕️

Waiting periods are separate from checks for pre-existing conditions. These conditions might still be excluded as a pet could appear healthy but have underlying or ongoing issues.

Fetch offers an upfront check for pre-existing conditions. After signing up, clients need to provide their vet's details in the app. Fetch will contact the vet for the pet's records and inform the clients of any pre-existing conditions that aren’t covered. This process usually takes a few weeks.

How do pet insurance waiting periods work?

A waiting period ⏱️ is the period of time your clients will need to wait for their coverage to begin after their pet's plan starts.

Fetch Pet insurance waiting periods

At Fetch, we have specific waiting periods for different types of cover:

Injuries (e.g., a broken leg from a fall or a cut paw): 48 hours

Illnesses (e.g., a tumor or kidney disease): 30 days

Specific Conditions (Cruciate Ligaments, Patellar Luxation, Hip Dysplasia, Elbow Dysplasia, BOAS, Cherry Eye): 90 days

Skip waiting periods with Fetch ⏭️

Fetch allows your clients to skip the waiting periods through a simple in-app process. 📲 After signing up, they need to follow the instructions to show their pet looking healthy. If everything checks out, Fetch can skip the waiting periods for their pet. ✅ This review is usually completed within 1 working day.

In the cover section of the app, clients can see the countdown of waiting periods and when they’re skipped.

Fast Claims and pre-existing condition checks 👩⚕️

Waiting periods are separate from checks for pre-existing conditions. These conditions might still be excluded as a pet could appear healthy but have underlying or ongoing issues.

Fetch offers an upfront check for pre-existing conditions. After signing up, clients need to provide their vet's details in the app. Fetch will contact the vet for the pet's records and inform the clients of any pre-existing conditions that aren’t covered. This process usually takes a few weeks.

Does Fetch cover hereditary or genetic conditions?

We cover genetic conditions, which include hereditary and congenital conditions as long as they aren't defined as pre-existing. Pre-existing conditions are when you noticed signs or symptoms or the condition was diagnosed/treated before your pet’s cover was active (including in any waiting periods ⏱️). Learn more here.

Does Fetch cover hereditary or genetic conditions?

We cover genetic conditions, which include hereditary and congenital conditions as long as they aren't defined as pre-existing. Pre-existing conditions are when you noticed signs or symptoms or the condition was diagnosed/treated before your pet’s cover was active (including in any waiting periods ⏱️). Learn more here.

Does Fetch cover hereditary or genetic conditions?

We cover genetic conditions, which include hereditary and congenital conditions as long as they aren't defined as pre-existing. Pre-existing conditions are when you noticed signs or symptoms or the condition was diagnosed/treated before your pet’s cover was active (including in any waiting periods ⏱️). Learn more here.

Are there breed-specific conditions or exclusions in pet insurance?

We cover all illnesses and injuries. There aren’t any breed-specific exclusions and we have no condition sub-limits. We can’t cover pre-existing conditions, which we check for you as part of our Fast Claims process. We also don't cover restricted breeds, or any dog declared dangerous or menacing.

Are there breed-specific conditions or exclusions in pet insurance?

We cover all illnesses and injuries. There aren’t any breed-specific exclusions and we have no condition sub-limits. We can’t cover pre-existing conditions, which we check for you as part of our Fast Claims process. We also don't cover restricted breeds, or any dog declared dangerous or menacing.

Are there breed-specific conditions or exclusions in pet insurance?

We cover all illnesses and injuries. There aren’t any breed-specific exclusions and we have no condition sub-limits. We can’t cover pre-existing conditions, which we check for you as part of our Fast Claims process. We also don't cover restricted breeds, or any dog declared dangerous or menacing.

How do claims work?

How do I submit a pet insurance pre-approval?

We can do pre-approvals for you and your vet, here’s how it works:

Start pre-approval request: In-app 📲, go to treatments, and click ‘new pre-approval’. Let us know which vet your pet will visit. You can track progress in-app, and we’ll notify you if we need more info.

We contact your vet: We’ll contact your vet for the treatment estimate and medical history.

Process pre-approval: If Fast Claims is set up, it’s within opening hours, we can check cover in 15 minutes. If not, we’ll contact all your pet’s vets to get their medical records back, but this can sometimes take a few weeks. If it's an emergency, send us a chat so we can pick it up straight away.

After treatment: We can change the pre-approval to a claim. Your vet just needs to send us the updated invoice and medical notes. You can either pay your contribution in-app and we’ll pay the vet the full amount. Or we can reimburse you if you’ve paid the vet already. Please note things can change between pre-approval and claim, like treatment type or cause, which can affect the claim outcome. Pre-approvals are valid for 28 days.

How do I submit a pet insurance pre-approval?

We can do pre-approvals for you and your vet, here’s how it works:

Start pre-approval request: In-app 📲, go to treatments, and click ‘new pre-approval’. Let us know which vet your pet will visit. You can track progress in-app, and we’ll notify you if we need more info.

We contact your vet: We’ll contact your vet for the treatment estimate and medical history.

Process pre-approval: If Fast Claims is set up, it’s within opening hours, we can check cover in 15 minutes. If not, we’ll contact all your pet’s vets to get their medical records back, but this can sometimes take a few weeks. If it's an emergency, send us a chat so we can pick it up straight away.

After treatment: We can change the pre-approval to a claim. Your vet just needs to send us the updated invoice and medical notes. You can either pay your contribution in-app and we’ll pay the vet the full amount. Or we can reimburse you if you’ve paid the vet already. Please note things can change between pre-approval and claim, like treatment type or cause, which can affect the claim outcome. Pre-approvals are valid for 28 days.

How do I submit a pet insurance pre-approval?

We can do pre-approvals for you and your vet, here’s how it works:

Start pre-approval request: In-app 📲, go to treatments, and click ‘new pre-approval’. Let us know which vet your pet will visit. You can track progress in-app, and we’ll notify you if we need more info.

We contact your vet: We’ll contact your vet for the treatment estimate and medical history.

Process pre-approval: If Fast Claims is set up, it’s within opening hours, we can check cover in 15 minutes. If not, we’ll contact all your pet’s vets to get their medical records back, but this can sometimes take a few weeks. If it's an emergency, send us a chat so we can pick it up straight away.

After treatment: We can change the pre-approval to a claim. Your vet just needs to send us the updated invoice and medical notes. You can either pay your contribution in-app and we’ll pay the vet the full amount. Or we can reimburse you if you’ve paid the vet already. Please note things can change between pre-approval and claim, like treatment type or cause, which can affect the claim outcome. Pre-approvals are valid for 28 days.

How do I submit a pet insurance claim?

Start new claim: In-app 📲, go to treatments, and click ‘new claim’. Let us know which vet your pet visited. You can track progress in-app, and we’ll notify you if we need more info.

We contact your vet: We’ll email your vet to upload the invoice and clinical notes to our portal.

Process claim: If Fast Claims is set up, it’s within opening hours, and your vet allows direct payments, we can work out cover in 15 minutes while you’re at the vet. You pay your contribution in-app, and we’ll transfer the full invoice to your vet. Otherwise, we can pay you the covered amount after your contribution.

How do I submit a pet insurance claim?

Start new claim: In-app 📲, go to treatments, and click ‘new claim’. Let us know which vet your pet visited. You can track progress in-app, and we’ll notify you if we need more info.

We contact your vet: We’ll email your vet to upload the invoice and clinical notes to our portal.

Process claim: If Fast Claims is set up, it’s within opening hours, and your vet allows direct payments, we can work out cover in 15 minutes while you’re at the vet. You pay your contribution in-app, and we’ll transfer the full invoice to your vet. Otherwise, we can pay you the covered amount after your contribution.

How do I submit a pet insurance claim?

Start new claim: In-app 📲, go to treatments, and click ‘new claim’. Let us know which vet your pet visited. You can track progress in-app, and we’ll notify you if we need more info.

We contact your vet: We’ll email your vet to upload the invoice and clinical notes to our portal.

Process claim: If Fast Claims is set up, it’s within opening hours, and your vet allows direct payments, we can work out cover in 15 minutes while you’re at the vet. You pay your contribution in-app, and we’ll transfer the full invoice to your vet. Otherwise, we can pay you the covered amount after your contribution.

Does Fetch pet insurance have GapOnly®?

GapOnly® is a service offered by one insurance provider called Petsure, who distribute under many different brands. Fetch is building Fast Claims ⚡️, designed to make the claims process quick and easy for you and your vet. Here’s how it works:

Assess health history: When you first join Fetch, let us know your pet’s vets (including any previous vets) and we can check their health history to identify any pre-existing conditions. This helps you know your pet’s cover upfront.

Direct payments to vets: If your vet supports direct payments, Fetch can pay the entire invoice to your vet. You only need to pay your contribution (including any excluded items) in-app first. Fetch doesn’t charge any fees for this service, and we can pay your vet in real-time, depending on their bank.

Quick processing: Claims are checked and paid in just 15 minutes, during opening hours and once all necessary information is provided.

Does Fetch pet insurance have GapOnly®?

GapOnly® is a service offered by one insurance provider called Petsure, who distribute under many different brands. Fetch is building Fast Claims ⚡️, designed to make the claims process quick and easy for you and your vet. Here’s how it works:

Assess health history: When you first join Fetch, let us know your pet’s vets (including any previous vets) and we can check their health history to identify any pre-existing conditions. This helps you know your pet’s cover upfront.

Direct payments to vets: If your vet supports direct payments, Fetch can pay the entire invoice to your vet. You only need to pay your contribution (including any excluded items) in-app first. Fetch doesn’t charge any fees for this service, and we can pay your vet in real-time, depending on their bank.

Quick processing: Claims are checked and paid in just 15 minutes, during opening hours and once all necessary information is provided.

Does Fetch pet insurance have GapOnly®?

GapOnly® is a service offered by one insurance provider called Petsure, who distribute under many different brands. Fetch is building Fast Claims ⚡️, designed to make the claims process quick and easy for you and your vet. Here’s how it works:

Assess health history: When you first join Fetch, let us know your pet’s vets (including any previous vets) and we can check their health history to identify any pre-existing conditions. This helps you know your pet’s cover upfront.

Direct payments to vets: If your vet supports direct payments, Fetch can pay the entire invoice to your vet. You only need to pay your contribution (including any excluded items) in-app first. Fetch doesn’t charge any fees for this service, and we can pay your vet in real-time, depending on their bank.

Quick processing: Claims are checked and paid in just 15 minutes, during opening hours and once all necessary information is provided.

How does Fetch Fast Claims work?

Fetch Fast Claims ⚡️ is designed to make the claims process quick and easy for you and your vet. Here’s how it works:

Assess health history: When you first join Fetch, let us know your pet’s vets (including any previous vets) and we can check their health history to identify any pre-existing conditions. This helps you know your pet’s cover upfront.

Direct payments to vets: If your vet supports direct payments, Fetch can pay the entire invoice to your vet. You only need to pay your contribution (including any excluded items) in-app first. Fetch doesn’t charge any fees for this service, and we can pay your vet in real-time, depending on their bank.

Quick processing: Claims are checked and paid in just 15 minutes, during opening hours and once all necessary information is provided.

How does Fetch Fast Claims work?

Fetch Fast Claims ⚡️ is designed to make the claims process quick and easy for you and your vet. Here’s how it works:

Assess health history: When you first join Fetch, let us know your pet’s vets (including any previous vets) and we can check their health history to identify any pre-existing conditions. This helps you know your pet’s cover upfront.

Direct payments to vets: If your vet supports direct payments, Fetch can pay the entire invoice to your vet. You only need to pay your contribution (including any excluded items) in-app first. Fetch doesn’t charge any fees for this service, and we can pay your vet in real-time, depending on their bank.

Quick processing: Claims are checked and paid in just 15 minutes, during opening hours and once all necessary information is provided.

How does Fetch Fast Claims work?

Fetch Fast Claims ⚡️ is designed to make the claims process quick and easy for you and your vet. Here’s how it works:

Assess health history: When you first join Fetch, let us know your pet’s vets (including any previous vets) and we can check their health history to identify any pre-existing conditions. This helps you know your pet’s cover upfront.

Direct payments to vets: If your vet supports direct payments, Fetch can pay the entire invoice to your vet. You only need to pay your contribution (including any excluded items) in-app first. Fetch doesn’t charge any fees for this service, and we can pay your vet in real-time, depending on their bank.

Quick processing: Claims are checked and paid in just 15 minutes, during opening hours and once all necessary information is provided.

Does Fetch cover online pharmacy claims?

Fetch covers medication 💊 for covered conditions where your vet has provided a prescription. Please include a picture of the pharmacy invoice in your claim. We’ll also ask your vet for a copy of the prescription, and your pet’s history if the medication is for a new condition.

For more details, see How do I submit a claim?

Does Fetch cover online pharmacy claims?

Fetch covers medication 💊 for covered conditions where your vet has provided a prescription. Please include a picture of the pharmacy invoice in your claim. We’ll also ask your vet for a copy of the prescription, and your pet’s history if the medication is for a new condition.

For more details, see How do I submit a claim?

Does Fetch cover online pharmacy claims?

Fetch covers medication 💊 for covered conditions where your vet has provided a prescription. Please include a picture of the pharmacy invoice in your claim. We’ll also ask your vet for a copy of the prescription, and your pet’s history if the medication is for a new condition.

For more details, see How do I submit a claim?

How do claims work if a pet is referred to a different vet or specialist?

If your vet refers you to another vet👨⚕️, such as a specialist, we’ve made the process easy for both of you. You can make a claim as you would with your usual vet in your Fetch app 📲, and we'll contact the new vet to process the claim.

How do claims work if a pet is referred to a different vet or specialist?

If your vet refers you to another vet👨⚕️, such as a specialist, we’ve made the process easy for both of you. You can make a claim as you would with your usual vet in your Fetch app 📲, and we'll contact the new vet to process the claim.

How do claims work if a pet is referred to a different vet or specialist?

If your vet refers you to another vet👨⚕️, such as a specialist, we’ve made the process easy for both of you. You can make a claim as you would with your usual vet in your Fetch app 📲, and we'll contact the new vet to process the claim.

How do I?

How do I contact Fetch Pet?

Just open a chat with us in-app or on our website, or email us at support@fetchpet.au. If you have an emergency claim and you need to us to give you or your vet a call, just message us in-app. We're open 9-5pm Weekdays, 9-3pm Sat, 9-1pm Sun & Public holidays AET (Exc. Christmas Day, Boxing Day, New Years Day, Easter Sunday)

How do I contact Fetch Pet?

Just open a chat with us in-app or on our website, or email us at support@fetchpet.au. If you have an emergency claim and you need to us to give you or your vet a call, just message us in-app. We're open 9-5pm Weekdays, 9-3pm Sat, 9-1pm Sun & Public holidays AET (Exc. Christmas Day, Boxing Day, New Years Day, Easter Sunday)

How do I contact Fetch Pet?

Just open a chat with us in-app or on our website, or email us at support@fetchpet.au. If you have an emergency claim and you need to us to give you or your vet a call, just message us in-app. We're open 9-5pm Weekdays, 9-3pm Sat, 9-1pm Sun & Public holidays AET (Exc. Christmas Day, Boxing Day, New Years Day, Easter Sunday)

How do I check cover when you’re closed?

We know emergencies don’t always happen in office hours. Here’s how to check your cover if we’re closed:

In the plan section of your app you can check:

- If your pet has any waiting periods or pre-existing conditions (after you’ve setup Fast Claims)

- Your pet’s remaining annual limit, excess and cover%

- Your pet’s plan PDS on what we cover, don’t cover and any t&cs

Remember, injuries are covered (up to the remaining annual limit and to the terms in your PDS) if they happen after your waiting period. For example, if your pet has been hit by a car or had a snake bite.

How do I check cover when you’re closed?

We know emergencies don’t always happen in office hours. Here’s how to check your cover if we’re closed:

In the plan section of your app you can check:

- If your pet has any waiting periods or pre-existing conditions (after you’ve setup Fast Claims)

- Your pet’s remaining annual limit, excess and cover%

- Your pet’s plan PDS on what we cover, don’t cover and any t&cs

Remember, injuries are covered (up to the remaining annual limit and to the terms in your PDS) if they happen after your waiting period. For example, if your pet has been hit by a car or had a snake bite.

How do I check cover when you’re closed?

We know emergencies don’t always happen in office hours. Here’s how to check your cover if we’re closed:

In the plan section of your app you can check:

- If your pet has any waiting periods or pre-existing conditions (after you’ve setup Fast Claims)

- Your pet’s remaining annual limit, excess and cover%

- Your pet’s plan PDS on what we cover, don’t cover and any t&cs

Remember, injuries are covered (up to the remaining annual limit and to the terms in your PDS) if they happen after your waiting period. For example, if your pet has been hit by a car or had a snake bite.

Fetch veterinary team

HC

HC

Dr Tina

Vet

Annie

Vet Nurse

HC

HC

Leanne

Vet Nurse

AM

AM

Dr Andrew

Vet

HC

HC

Katrina

Vet Nurse

HC

HC

Kate

Vet Student

HC

HC

Aisling

Vet Student

HC

HC

Amanda

Vet Nurse

HC

HC

Ash

Vet Nurse

HC

HC

Luci

Vet Nurse

Want to join us?

We're looking for people who want to help transform pet healthcare. Who think big but love getting their sleeves rolled up to to get things done.